Each bank introduces different type of product according to their policy which is mainly based on customers demand and Banks profitability. They all can avail an array of products with an underlying mode of debt only from a conventional bank.

Islamic And Conventional Banking Ppt Video Online Download

They provide marginal interest rates between loan rates and loans.

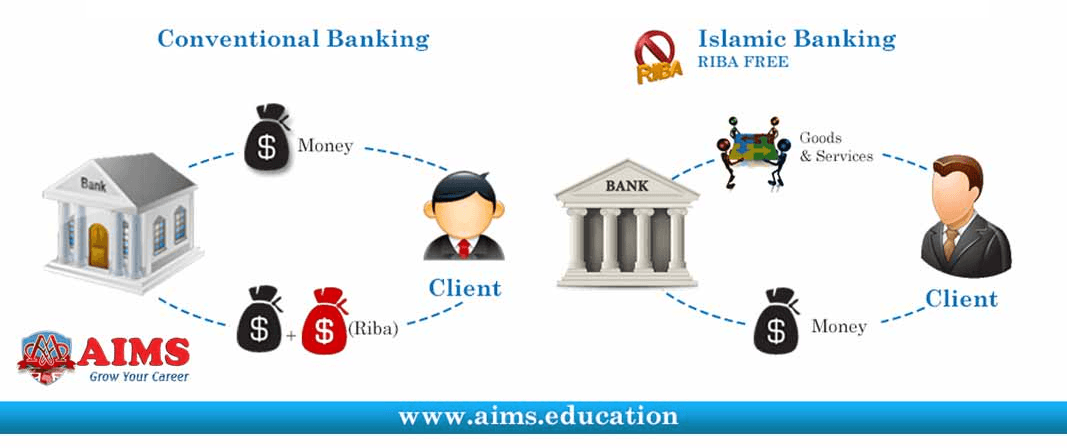

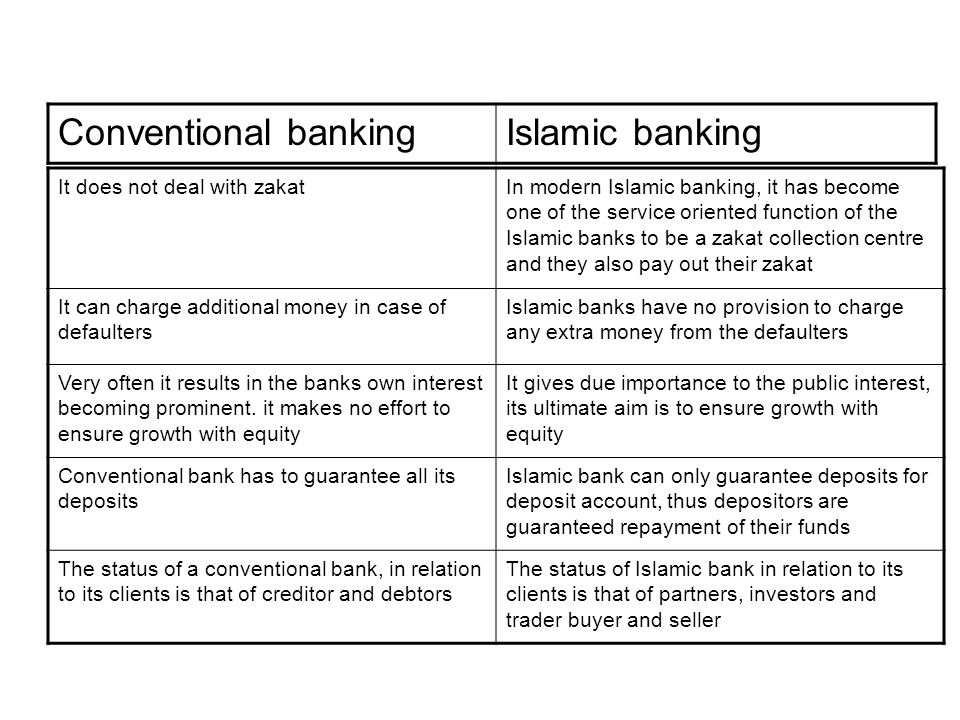

. Islamic Banks are not money lending institutes but they work as a trading investment house. Conventional banking is essentially based on the debtor-creditor relationship between the depositors and the bank on the one hand and between the borrowers and the bank on the other. By involving the purchase of goods it gets around the prohibition to make a return on money lending.

Conventional Banking Conventional banks only have one mode of financing for its customers and that is Loan. Conventional banks are in the business of lending borrowing money based on interest. However conventional banks have designed several.

A conventional bank is a financial body which receives money from depositors against fixedvariable rate of interest and offers liquidity to borrowers against repayment of interest plus principal. Means bank operating in accordance with traditional banking practice. Working capital is provided on interest rates based on per month basis.

No risk of underlying assets 2. The conventional bank is based on a full-fledged intermediary model that lends borrowers to suppliers and then loans to companies or individuals. B the persons attending such an assembly.

Used to refer to weapons that are not nuclear or to methods of. Politics an assembly of delegates of one party to select candidates for office. Conventional banks lend capital financing based on collateral and guarantee of the borrower and interest.

Mainly based on the man rules the conventional banking system at the difference of the Islamic banking system major principles are fixed or set by international financial institutions and governments of the countries in question and do not follow or shift to any religious book or principles to guide them this is why the name of the mans. Conventional banks offer lending facilities to their clients to fulfil their cash requirement on the basis of loan contracts where the relationship between the Bank and client is that of lender and borrower respectively. Conventional financing is a home financing scheme offered by financial institutions or banks which are not guaranteed by government agencies.

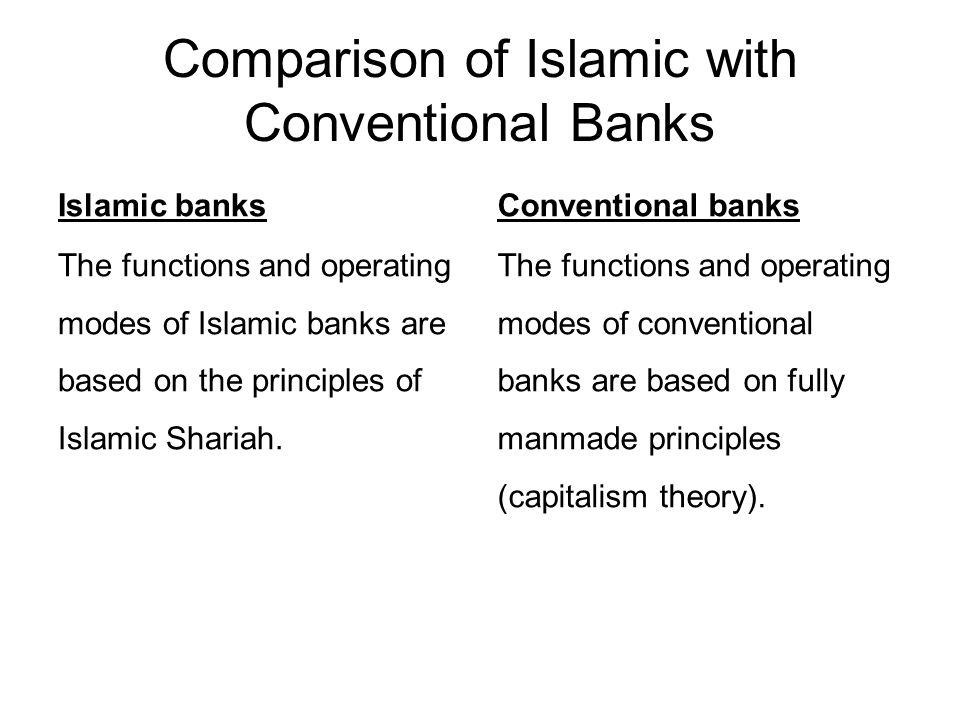

3 Diplomacy an international agreement second only to a treaty in formality. Let us take a deep review major difference between Islamic banking and conventional banking system and compare their key characteristics. Be it an individual customer a business partnership or a corporate client.

Deposits The liability side. By conventional banks we mean that the bank which is practicing the interest based principles. As stated earlier that conventional banks charging interest on in different rate form the borrowers.

Income through Interest 3. What are the features of the. A a large formal assembly of a group with common interests such as a political party or trade union.

Interest is considered to be the price of credit reflecting the opportunity cost of money. They also provide banking services such as credit cards and guarantees. A bank is a financial institution licensed as a receiver of deposits and can also provide other financial services such as wealth management.

Electronic banking is doing all of your banking needs online or on your phone. Conventional banking is a person walking into a bank and talking to another person. We now would like to make a comparison of these activities with Islamic concept of banking.

Conventional loans are given as per guidelines issued by government-sponsored entities. Conventional Banking Loan Contracts Characteristics. In Conventional banks we see no such restrictions.

As in leasing contracts the bank buys an investment good on behalf of the client and then on-sells it to the client with staggered payments and a. The conventional banking which is interest based performs the following major activities. This ensures that such loans can be sold in the secondary market.

Financing Refer to section IV Agency services. Conventional banking provides a financial service that does not have any morals or values to follow and has no ethical concerns instead their main purpose is to allow profit to be created with very little restrictions.

College Of Business Administration Ppt Download

/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

Fundamental Differences Between Islamic And Conventional Banking Download Scientific Diagram

/dotdash-career-advice-investment-banking-vscommercial-banking-v2-40d345c1ceab422ba547c2b8ecf5ec25.jpg)

Investment Banking Vs Commercial Banking What S The Difference

Difference Between Islamic Banking And Conventional Banking Aims Uk Youtube

Differences Between Conventional Banks And Islamic Banks Download Scientific Diagram

:max_bytes(150000):strip_icc()/dotdash-career-advice-investment-banking-vscommercial-banking-v2-40d345c1ceab422ba547c2b8ecf5ec25.jpg)

Investment Banking Vs Commercial Banking What S The Difference

Islamic Banking Vs Conventional Banking Aims Uk

Key Differences Between Islamic And Conventional Banking Source Download Scientific Diagram

Definition Of Conventional Banking Pepperqwex

Islamic Banking And Conventional Banking Www Informationsecuritysummit Org

Commercial Banks It S Functions And Types Explained

21 Advantages And Disadvantages Of Commercial Banks Googlesir

Difference Between Islamic And Conventional Banking Youtube

Fundamental Differences Between Islamic And Conventional Banking Download Scientific Diagram

Differences Between Conventional Banks And Islamic Banks Download Scientific Diagram

Islamic Conventional Banking Ppt Video Online Download

Commercial Bank What You Need To Know About Commercial Banks

Difference Between Islamic Banks And Conventional Banks